Gift vs Grant

Gift vs. Grant: Research Funding Classification

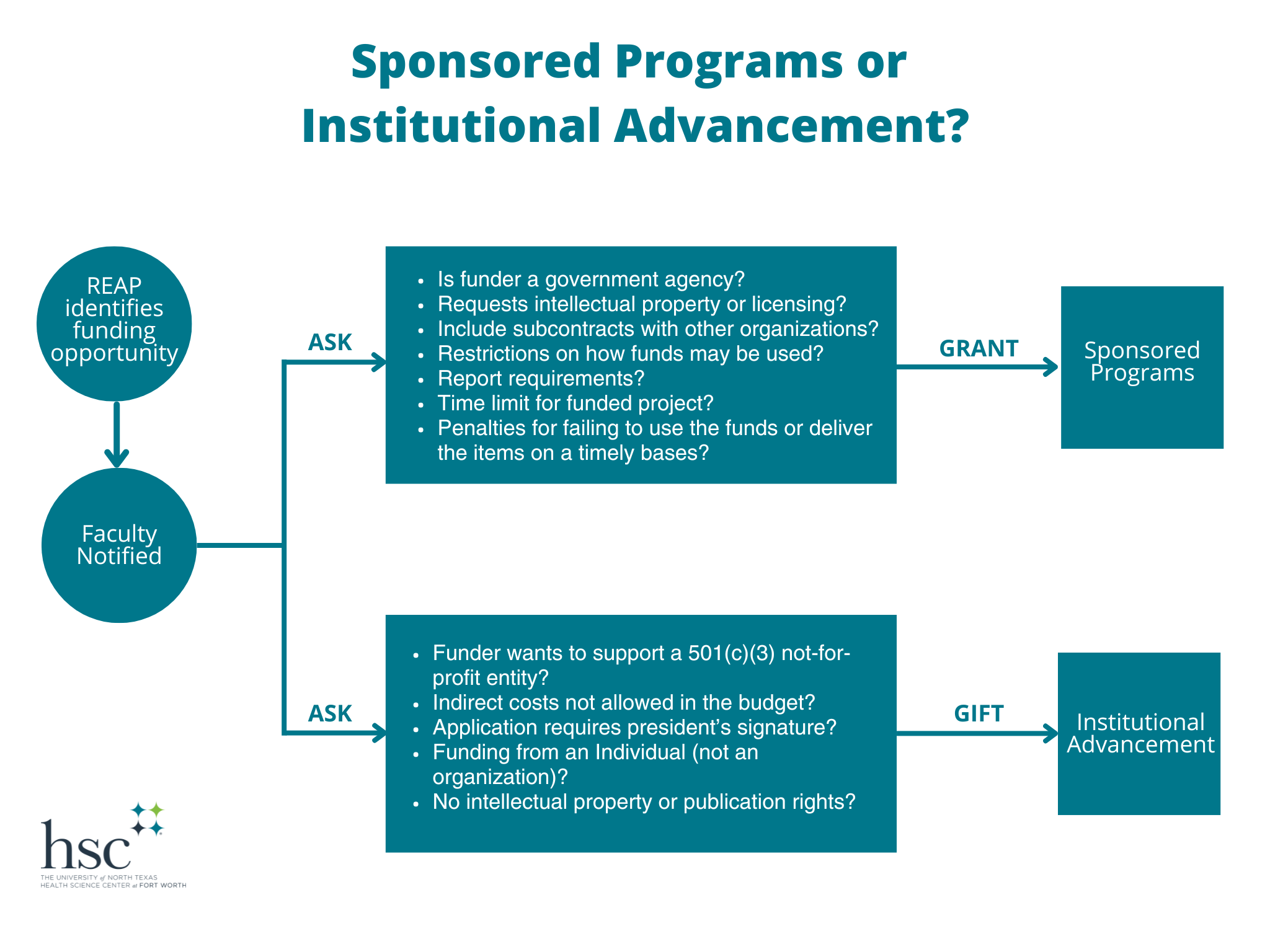

The accurate classification of funding is important to develop positive relationships with external funders, avoid delays in releasing the funds, and violating policies and regulations. HSC Institutional Advancement (IA) and the Office of Sponsored Programs (OSP) collaborate to classify funds based on the funder’s intent and requirements and compliance with University policies and Federal and State mandated regulations.

Rather than focusing on any single characteristic, each award must be considered in its totality. To clarify the process of determining classification and assure greater consistency among the various colleges, schools, departments, centers and administrative units of the University, please review the chart below.

Often individuals receive money and have difficulty differentiating whether it is a gift or a grant. The criteria for determining whether funds are categorized as a gift or grant sometimes overlap and require evaluation based on a number of characteristics listed below. Not all characteristics must be present, however, if in doubt please contact the Office of Sponsored Programs for review.

| GIFT | GRANT | |

| Executed by | Institutional Advancement | Office of Sponsored Programs |

| Definition | Gifts are irrevocable transfers of assets, i.e. contributions from private sources, for which no goods or services are expected, implied, or forthcoming in return to the donor, and in which no proprietary interests are to be retained by the donor. | Grants are those undertaken by the University with the support of an external entity which expects in return specific outcomes that either directly benefits the provider or a public purpose. |

| Represents | An unconditional transfer of cash, securities, etc. which is voluntary and non-reciprocal | An “exchange transaction” in which each party receives commensurate value |

| Also Known as | The term “gifts” refers exclusively to private gifts, even though such gifts may be termed “grants” by corporations and foundations. | Sponsored Activities, Research Grant, Sponsored Research |

| Scope of Work/Reporting | Limited financial reporting or progress reporting for stewardship purposes only. No deliverables or scope of work required. | The provider requires the University to report on how the funds were spent and/or what progress has been made in accomplishing the goals of the activity |

| Time Period | No specific time period | Usually has a specified time period over which the work will be done (a start date and an end date) |

| Funding | General restrictions on the use of funds without controlling the expenditures | Any right to direct expenditures including choosing vendors and/or subcontractors. Sometimes requests that unused funds must be returned to the awarding agency/foundation/corporation |

| Audit | No audit | Right to audit |

| Intellectual Property |

No Intellectual property or publication rights | Contains intellectual property provisions, including exclusive rights, first right or shared rights, etc. |

| Examples | Naming of a room, building, program, college/school, scholarship, etc. | Any testing of a sponsor’s drug Any clinical trial |

Social media